As you very well know, B and I became parents this past August. Our whole world changed in the blink of an eye; a moment I’ll truly never ever forget. While I knew our life would change, I had no idea how much it would change for the better. When people said that it would change your life, I always heard it with a negative slant. You see, we really loved our life prior to Gemma; we got married young we had a solid ten years with each other which included lots of memories, lots of experiences and lots of mistakes. When people mentioned kids changing everything, in a way it made me cling to our life even more; thinking that once we did have children the change would negate the good of our previous or current life. Boy, was I wrong. Having Gemma didn’t subtract from our lives one bit, but instead, it multiplied everything good. In fact, our life isn’t so different now, except that we get to share it with her. How amazing is that? (Okay, okay so it subtracted some sleep, that is true. B and I talk about how we *used* to get mad when we didn’t get a full 8 hours of sleep at night… LOL FOREVER.)

Since we waited a while to have kids and with our tenth — yes I said tenth — anniversary coming up next year, we really took our sweet time. As we learned, when you get married in your early twenties, you have to grow up together fast. We were on our at the age of 23 and let me just say, we made a few mistakes. I wouldn’t say we made a ton of financial mistakes, but we definitely took our time when it came to figuring out the importance of having your finances in order. One thing I wish we would have done from day one was put more importance into a savings account. In a young marriage, there are always a lot of surprise expenses and we seemed to find every single one of them out there. From cars breaking down to moving expenses (side note — why do we move so much in our 20s? B and I became expert packers and U-Haul drivers), we finally realized that having an emergency fund saved up was a much better idea than putting all of our surprises on a credit card. Of course, we learned the hard way as most 20-somethings do with our financial mishaps. That is one reason I’m glad we waited a few years to have Gemma — we made our lot of mistakes and we know a lot more than we did 10 years ago thanks to those unsaid mistakes. Our mistakes are Gemma’s gain. We like it that way.

Before Gemma was born, we knew that we wanted to make the best financial decisions for her and setting up a savings account for her was first on our to-do list. You are never too young to start saving money. My parents did this for me when I was in my teens and years later I was able to use that money to buy a car after college and even use some of the money for my wedding. Our plan for Gemma is simple: We will put money aside in her savings account every month, just as we do our own savings. We know that eventually, we want to teach Gemma how to save money because spending money is the easiest lesson to learn. (She’s got a really good teacher for that shopping lesson: her mama.) I learned financial responsibility from watching my parents tend to their money with care and I lead by the same example for Gemma.

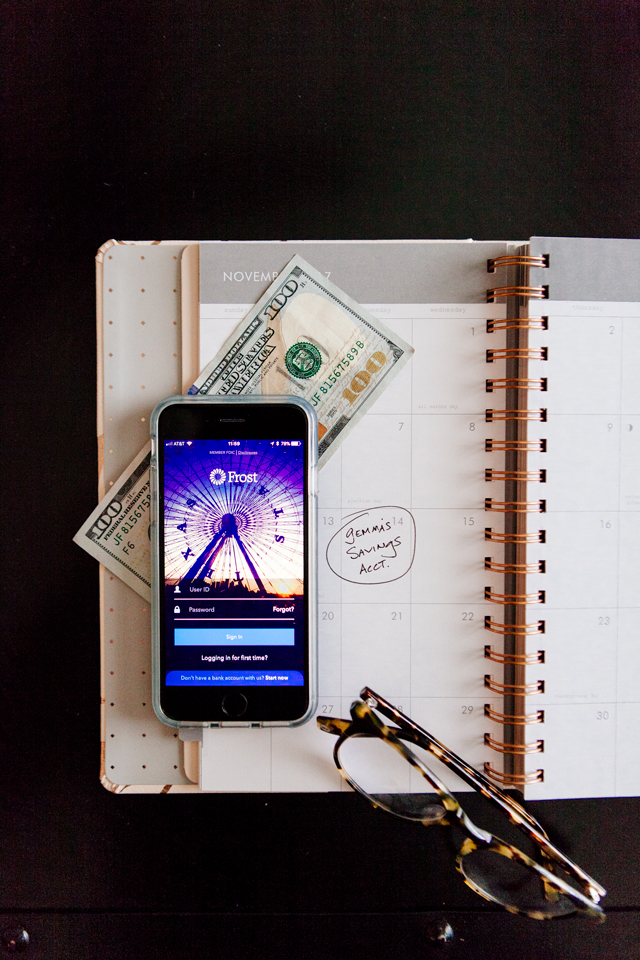

Now Gemma baby is just 3 months old, so she has a lot of other important things she needs to learn before we dive into the importance of a savings account with her. (Currently we are working on getting our toes in our mouth, so you know… VERY important stuff over here. We can talk money much later.) But when she is old enough and ready to learn the importance of saving, we will have a nice amount set aside for her to add to. Frost Bank has been a great assistance with helping us set up a bank account for her. We set it up quickly online, with a simple amount of $100 (but you can easily open an account with just $25.) Each month we have decided to put back a set amount of money for her on the 14th since that’s the day she was born. I’ve put this on my calendar and I know on the 14th, that’s Gemma’s savings day. The best part is we don’t even have to make a trip to the bank with the ease of Frost Bank’s online amenities. It’s as easy as 1-2-3. In a way, it’s like a modern-day piggy bank. I can imagine Gemma when she’s older and helping me ‘deposit’ money in her savings account via the app. Every month on the 14th, we can open the Frost Bank app, make a quick deposit and she can see her ‘piggy bank’ grow with her.

*This post is in partnership with Frost Bank. Special thanks to them for helping us get a jumpstart on our little Gem’s financial goals.

4 Responses

Nice post hun! 🙂

http://www.evdaily.blogspot.com

So precious! And what a great idea to start so early. She will definitely appreciate that in about 20 years 😉

Absolutely love it!

Mireia from TGL

https://thegoldlipstick.com/

I loved this post. I think it’s so neat how you both waited so long to have kids and Gemma is literally one of the cutest babies I have ever seen. This app sounds really neat too! I’ve always been a saver but would love to have a separate account for it.

Kendall

http://www.weekendall.com